If you are nearing retirement, most of us would rather spend our days debating between a destination in the sun or in the snow. However, there are still some important healthcare decisions to be made before traveling. Will you enroll in a Medicare Advantage, Medicare Supplement and/or prescription drug plan, or will you stick with Original Medicare coverage.

In the world of Medicare, terminology is thrown around like a basketball in the middle of March Madness. It can be challenging to keep up—allow us to break things down to help you understand the key differences.

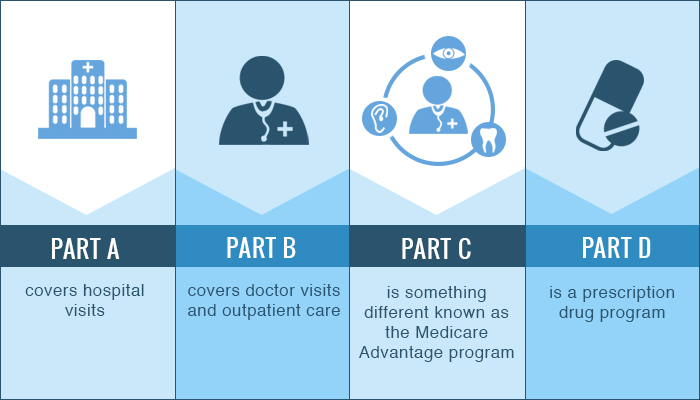

There are four different parts of Medicare: A, B, C, and D:

- Part A covers hospital visits

- Part B covers doctor visits and outpatient care

- Part C is something different known as the Medicare Advantage program

- Part D is a prescription drug program

Original Medicare is comprised of Part A and Part B and is administered by the federal government.

Medicare Advantage (Part C)

Here’s where things get a little more complicated. Medicare Advantage plans cover Part A and Part B benefits. They often cover extra benefits not included with Original Medicare, such as vision, hearing, and dental care. Medicare Advantage plans are provided and administered by private insurance companies who have been approved by the Centers for Medicare and Medicaid Services (CMS), a government entity who oversees the Medicare program. Medicare Advantage plans often cover all parts of Medicare including Medicare Part D which is the prescription drugs plan. Often times these plans cost little to no additional cost to have as you are entitled to these plans as long as you have both parts of Original Medicare (A and B). These plans have become very popular because they often include all parts of Medicare (A,B,C &D) for often no additional costs – with wide variety of of PPO, HMO, POS, RX, SNP types of coverage models to best fit your needs. Many people find that most if not all of their providers are already in-network with these plans and experience no change of care providers if desired.

With Medicare Advantage plans, you still need to continue paying Part A and/or B premiums as you would with Original Medicare. However, the amount you pay for a doctor’s visit, hospital stay or other medical expenses is different between Medicare Advantage plans and Original Medicare.

For example: Original Medicare covers most doctors’ visits at 80% after you fill a small deductible. With a Medicare Advantage plan, there is usually a very small copay and then the plan covers the rest of the cost.

Find Medicare Advantage Plans Here.

Medicare Supplement

Medicare Supplement plans, also called Medigap plans, require you to be enrolled in Original Medicare. These plans are offered by private companies, but they act as a secondary insurance policy—covering deductibles, copays and other out-of-pocket expenses that Original Medicare would make you pay. Original Medicare also does not cover health care costs while traveling outside of the United States, but Medicare Supplement plans usually will. In addition, most of these type of plans also do not have Medicare Part D or prescription drug plans, therefore you will likely need to purchase another in addition to a medicare supplement plan.

These are the basic differences—there are many additional factors that differ between Medicare Advantage and Medicare Supplement plans.

FIND MEDICARE SUPPLEMENT PLANS

Differences to Consider

Network Access

When it comes to Medicare Advantage plans, more times than not you will need to see a doctor in the plan’s network established by the carrier. You may see a doctor outside of the network—keep in mind it will cost more if you choose to do so. For Medicare Supplement plans, if your provider accepts Original Medicare, you don’t need to worry. You may visit any doctor or hospital that accepts payment from Medicare.

Prescription Drug Coverage

Most Medicare Advantage Plans include benefits for prescription drug coverage. These are referred to as Medicare Advantage Prescription Drug plans (MAPDs). Medicare Supplement plans do not cover prescription drugs. If you choose to go with a Medicare Supplement plan, you can enroll in a Part D plan which specifically covers prescription drugs. Part D plans are available through private insurance companies.

Long-Term Care

Many Medicare Advantage and Medicare Supplement plans do not cover long-term care but do offer short-term care.

Vision & Dental Care

Many Medicare Advantage plans cover vision and dental care benefits. Medicare Supplement plans usually don’t cover vision and dental care benefits. But some Medicare Supplement plans do offer a discount program to help reduce vision and dental care expenses.

Hearing

Some Medicare Advantage plans include hearing benefits, such as regular hearing exams and hearing aids. Medicare Supplement plans don’t cover hearing aids or exams.

Eligibility

Medicare Advantage plan options vary state to state and in some cases county to county. Keep in mind you may only enroll in plans that are available in your network or area. You must first be enrolled in Medicare Parts A and B. With Medicare Supplements, you must also be enrolled in Medicare Part A and Part B. In some instances, eligibility for Medicare Supplement coverage may depend on your current health status or other factors.

Which one is right for me?

Regardless of what route you choose, it’s important to weigh the benefits and downfalls of both Medicare Advantage and Medicare Supplement plans. Because you must enroll in one or the other—you cannot have both.

Questions? Talk to one of our Certified Medicare Specialists.

#medicare#medigap#medicaresupplement#healthcare#cms#aep#openenrollment#medicareadvantage#medicaid